Cryptocurrencies have successfully created a massive community of followers and enthusiastic investors. Recently, the arrival of wrapped Bitcoin alongside other wrapped crypto tokens has been garnering attention in the crypto landscape. Blockchains, the underlying technology behind Bitcoin and Ethereum, come in the form of different protocols. They have different functionalities and basic differences in their algorithms.

As a result, the interoperability between two networks drops considerably. Some may assume that this highlight reflects the sovereignty and security of each blockchain. On the other hand, the lack of interoperability imposes restrictions on the vision for an ecosystem that enables easy exchange of data and information. Therefore, wrapped crypto tokens emerged as a solution for enabling communication among the earliest blockchain networks. The following post offers you a detailed outline of wrapped cryptocurrencies such as wBTC and their significance.

Want to become a bitcoin expert? Enroll Now in Getting Started with Bitcoin Technology Course

What is Wrapped Bitcoin?

The first thing in a discussion on wrapped crypto tokens would point at the definition of wBTC Bitcoin. WBTC is just a tokenized variant of Bitcoin, which runs on the Ethereum blockchain network. You can think of the simplest answer for wrapped Bitcoin vs. Bitcoin comparison in the fact that wrapped BTC is basically an Ethereum token. The Ethereum token provides representation for Bitcoin on the Ethereum blockchain network.

Some of you may have assumed that wrapped BTC is another variant of Bitcoin. On the contrary, it is a different ERC-20 token, which has been tailored for tracking the value of Bitcoin. The compliance with ERC-20 standard ensures that WBTC can serve flexible integration within the Ethereum ecosystem. As a result, it can showcase functionality on all the related solutions, such as decentralized exchanges, crypto lending services, and prediction markets.

Origins of Wrapped Bitcoin

The next important question regarding wrapped Bitcoin or WBTC would point at its origins. Interestingly, WBTC is only a part of a larger wrapped tokens project, which has not been developed by individuals. Three notable organizations have contributed to the origins of wrapped BTC, and their names are Kyber Network, Ren, and BitGo. The first-ever instance of a proposal for wrapped BTC was recorded on October 26, 2018.

Subsequently, the first-ever official release of WBTC was documented on January 31, 2019. It is also important to note that WBTC is the native utility token and can serve different purposes on the Wrapped BTC network. Bitcoin holders could use WBTC to become a part of the decentralized finance ecosystem. You can think of the wrapped cryptocurrency token as a formidable financial instrument for accessing the Ethereum network with Bitcoin.

From a broader perspective, the wrapped Bitcoin vs. Bitcoin boundary becomes clear with an emphasis on primary goal of WBTC. Wrapped BTC has been designed to employ the price value of Bitcoin into play and blend it with the programmable traits of Ethereum. The origins of wrapped BTC must also reflect on the fact that WBTCs are ERC-20 tokens serving as 1:1 representations of Bitcoin.

It is also important to note that a network of automatically monitored merchants and custodians helps in achieving the 1:1 representation. Therefore, wrapped BTC can offer better flexibility for transferring liquidity between Bitcoin and Ethereum blockchain networks.

Want to learn and understand the scope and purpose of DeFi? Enroll Now in Introduction to Defi- Decentralized Finance Course

Special Highlight of Wrapped Bitcoin

The next question on everyone’s mind right now must be, “Is wrapped Bitcoin better?” when compared to Bitcoin. Different renowned DeFi apps on Ethereum demand collateral for offering their services. For example, popular DeFi solutions such as Compound and MakerDAO emphasize the need for locking up crypto assets to access lending services.

It is also important to note that the overall value associated with ETH is considerably less than Bitcoin. Therefore, both protocols encounter some critical limitations for growth. WBTC Bitcoin can help in introducing Bitcoin alongside offering a boost in liquidity for the protocols for creating more sources of collateral. WBTC can also help Bitcoin owners in holding on to their Bitcoin while leveraging it in DeFi apps.

The doubts regarding wrapped Bitcoin price seem trivial when you look for the element of trustless interactions. Even if the price of WBTC is pegged at 1:1 against Bitcoin, trust among people emerges as an important requirement. Bitcoin and Ethereum cannot communicate with each other natively, and the interactions between the blockchain networks require security. On the contrary, wrapped BTC cannot offer the same security as Bitcoin or the assurance of trustless transactions. Why? The working of wrapped BTC relies profoundly on people and other organizations for management of the system.

As of now, the special highlight in a wrapped Bitcoin vs. Bitcoin comparison would refer to increased trust and transparency with wrapped BTC through regular audits. The wrapped BTC network passes through frequent audits alongside ensuring publication of all the on-chain transactions and verification for Ethereum and Bitcoin networks.

Users could also leverage the features of the platform for independent verification of the number of WBTC tokens delivered to WBTC address on Bitcoin blockchain. Subsequently, users can also verify whether the transactions align with the creation of Wrapped Bitcoin tokens on Ethereum blockchain.

Excited to learn the basic and advanced concepts of ethereum technology? Enroll Now in The Complete Ethereum Technology Course

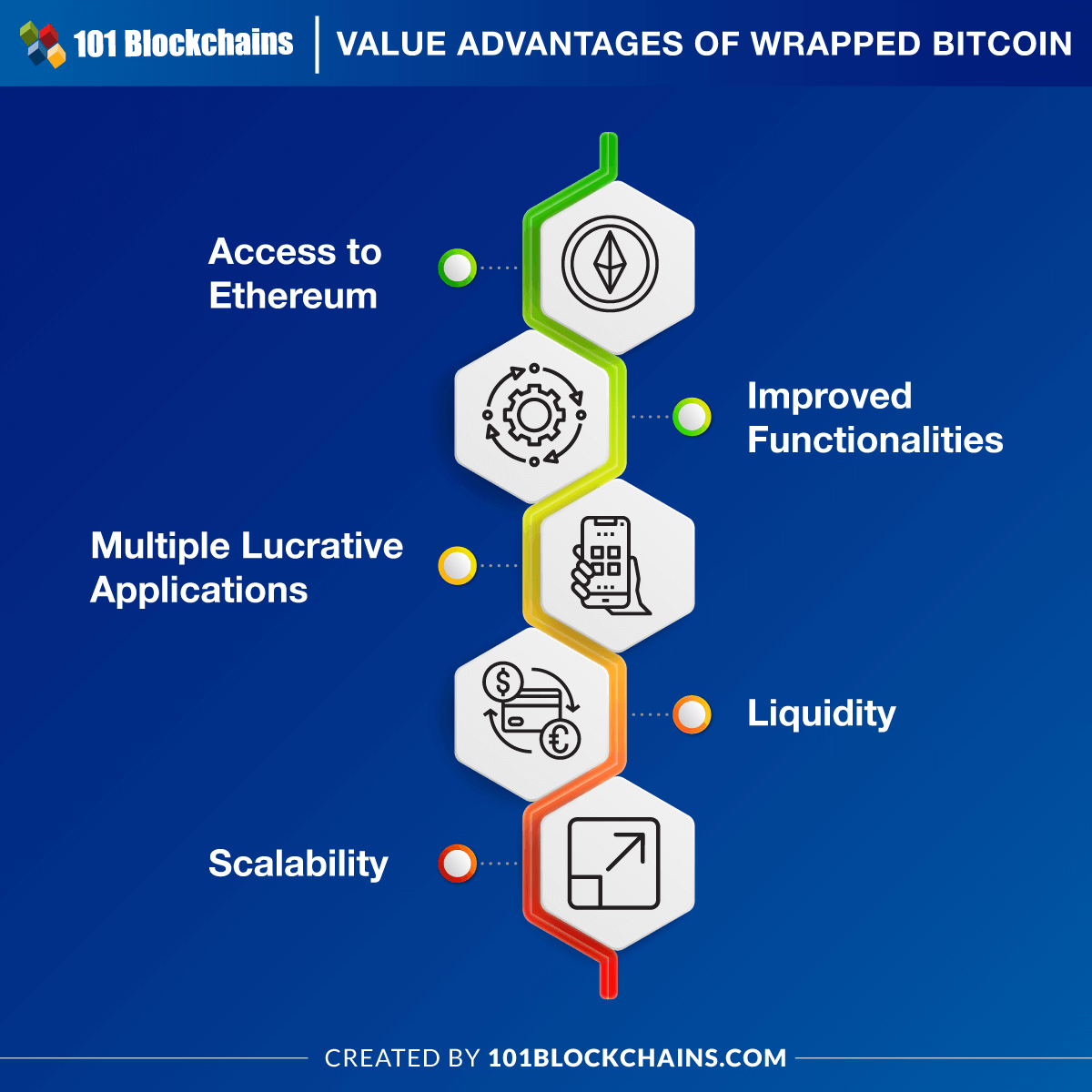

Value Advantages of Wrapped Bitcoin

The special highlights of wrapped BTC create a lot of curiosity regarding the value advantages of wrapped crypto tokens. The details of WBTC might force an individual to wonder about the reasons for converting their Bitcoin into wrapped BTC. Here is an outline of the value advantages you can find with wrapped BTC.

-

Access to Ethereum

The biggest advantage with WBTC Bitcoin refers to the access to Ethereum ecosystem. Bitcoin owners could access the massive network of Ethereum-based applications such as decentralized wallets, crypto exchanges, smart contracts, decentralized applications, and games. Wrapped crypto tokens like WBTC can serve vital support for accessing a comprehensive variety of DeFi lending and borrowing networks. Interestingly, Bitcoin owners don’t have to give up their Bitcoin directly.

-

Improved Functionalities

The special highlights in a wrapped Bitcoin vs. Bitcoin comparison would draw the limelight on the improved functionalities with wrapped BTC. For example, you can avail the additional functionalities through opportunities for leveraging Ethereum smart contracts. Smart contracts offer the flexibility for creating pre-programmed protocols, and they serve as one of the core technologies in the blockchain sector. On the other hand, Bitcoin cannot offer the flexibility for capitalizing on smart contract capabilities.

-

Multiple Lucrative Applications

The innovation in use of wrapped BTC could also provide an ideal answer for questions like “Is wrapped Bitcoin better?” with examples such as DeFi BTC. You must notice that the growth of DeFi resulted in the need for creating wrapped BTC to enter the ecosystem. Therefore, DeFi is basically the spark that fuelled the rise of wrapped crypto token projects.

Interestingly, WBTC can find promising applications in staking, one of the common DeFi functionalities. As of now, you can discover multiple versions of staking protocols in the DeFi landscape. Users must lock their cryptocurrencies in smart contracts with these staking protocols for earning rewards after a specified time duration. Users can convert Bitcoin to wrapped Bitcoin and use their cryptocurrency effectively in next-gen staking protocols.

Another significant application of wrapped BTC in the domain of DeFi would deal with yield farming. Yield farming basically refers to a DeFi protocol with considerable differences from staking, such as the shorter lockup periods. The applications of WBTC in yield farming protocols such as Compound strengthens the case for the future of these wrapped cryptocurrency tokens.

-

Liquidity

Another clearly evident benefit of WBTC Bitcoin is liquidity. The massive and diverse Ethereum ecosystem can offer many opportunities while hiding certain setbacks in the background. The distribution of funds could result in scenarios with decentralized exchanges and different platforms lacking liquidity for optimal functions. Without liquidity, an exchange could not serve the effectiveness as it cannot facilitate quick trade of tokens.

At the same time, users might not find the trading conditions for their tokens favorable. WBTC helps in integrating the liquidity associated with BTC into the flexibility of Ethereum. As a result, wrapped BTC can help in reducing the liquidity loophole for various centralized finance and decentralized finance products.

-

Scalability

The emphasis on scalability is also one of the significant highlights for any crypto owner. Wrapping Bitcoins can help in transferring them to the Ethereum blockchain network. As a result, you don’t have to transfer the Bitcoin directly, thereby ensuring favorable savings with wrapped Bitcoin. The transactions with wrapped Bitcoin cost less and are faster, thereby ensuring additional storage and transaction options.

The popularity of wrapped Bitcoins is not a joke anymore, as there is almost $1.1 billion worth of WBTCs all over the world.

Want to know the working process and infrastructure of Bitcoin quickly? Check the presentation Now on What Is Bitcoin and How Does It Work

Models of Wrapped Bitcoin

The understanding of wrapped Bitcoin vs. Bitcoin differences shows how WBTC introduced major improvements over Bitcoin. Interestingly, you can come across various BTC wrapping models for use within this sector. Every strategy features its unique highlights, albeit with the same outcome of representing Bitcoin on the Ethereum blockchain. Here are the three important protocols which help in the WBTC Bitcoin conversion process.

-

Centralized Wrapping

The centralized strategy for wrapping Bitcoin focuses on choosing an organization that would maintain the value of the assets. Crypto owners have to offer their Bitcoin to a centralized intermediary. They would lock the cryptocurrency in a smart contract and provide the relevant ERC-20 token in return. The only disadvantage of the centralized method for wrapping Bitcoin is the reliance on the firm for maintaining and securely storing Bitcoin.

-

Synthetic Assets

The discussions on “Why would you wrap a Bitcoin?” have also played a major role in advocacy for synthetic assets. The method of using synthetic assets for wrapping Bitcoin has been gaining considerable popularity in recent times. Such designs help you lock your Bitcoin in a smart contract in return for a synthetic asset of equal value. However, the synthetic asset does not have direct backing of Bitcoin. On the contrary, the platform would back up the asset with native tokens.

-

Decentralized Wrapping

The ideal alternative to a centralized method for wrapping Bitcoin refers to the trustless method. A decentralized system for wrapping Bitcoin offers a better and more advanced approach. For example, Keep Network provides wrapped Bitcoin services with tBTC tokens.

The method of decentralized wrapping basically involves transfer of centralized custody to smart contracts. The Bitcoin of users remains in a network contract that cannot be modified without the approval of users. As a result, users can access a trustless and autonomous system for wrapping their Bitcoin.

Want to know the real-world examples of smart contracts? Check the presentation Now on Examples Of Smart Contracts

How Can You Wrap Bitcoin?

The details of different methods for wrapping Bitcoin show how you can try the same easily. Interestingly, you can find platforms such as Coinlist for an easier experience of wrapping Bitcoins. It is important to note that Coinlist offers the assured 1:1 value representation while also ensuring zero spread. The platform takes only a flat fee amounting to 0.025% of the number of Bitcoins being wrapped. Here are a few simple steps for wrapping a Bitcoin.

- Access the Coinlist website and register with an account on the website.

- Click on the “Wrap” button from your Bitcoin wallet.

- Enter the number of Bitcoins you want to convert into WBTC Bitcoin.

- Select “Confirm Wrap” button for processing the transaction.

If you don’t want to wrap your Bitcoins directly, then you can purchase wrapped Bitcoin from popular exchanges. Some of the notable exchange offerings wrapped in BTC include Uphold, KuCoin, Bitstamp, and Binance. In addition, you should also note that you can use other platforms such as Poloniex and Atomic Wallet for converting Bitcoin into WBTC.

Risks of Wrapped Bitcoin

The introductory highlights on wrapped BTC show promising answers for “Why would you wrap a Bitcoin?” with practical value advantages. In addition, the overview of methods for wrapping Bitcoin can encourage you to convert your BTC into a wrapped BTC. However, it is important to hold your step and look for the limitations and risks evident with wrapped BTC.

Is it safe to invest in wrapped BTC? The technical specifications of wrapped crypto tokens showcase that wrapped BTC tokens are inherently safe. Even if the WBTC remains in control of platforms such as Binance Smart Chain or Ethereum, users will have the benefit of safety of the platforms.

However, the security offered by the custodian may not necessarily translate into positive outcomes over the long term. If custodians unlock and release the Bitcoin associated with an ERC-20 token, then the relevant wrapped Bitcoin would become valueless. Therefore, it is important to note that the security of wrapped Bitcoins depends on the custody and the level of security offered.

Get familiar with the terms related to ethereum with Ethereum Flashcards

Bottom Line

The overview of the fundamentals of wrapped BTC shows that the new digital asset could introduce promising improvements for interacting with DeFi ecosystems. Bitcoin and Ethereum have been traditionally separate from each other without any scope for interoperability. Bitcoin owners cannot capitalize on the DeFi services based on Ethereum alongside the other decentralized applications in the Ethereum ecosystem.

The functionalities of WBTC Bitcoin can help in representation of Bitcoin as an ERC-20 token on the Ethereum network. As a result, Bitcoin owners can become an integral part of the emerging ecosystem of DeFi applications. More than the applications in DeFi, wrapped crypto tokens can open new roads for ensuring better liquidity. Learn more about wrapped crypto tokens and their technical specifications in detail before trying them.

Join our annual/monthly membership program and get unlimited access to 25+ professional courses and 55+ on-demand webinars.

*Disclaimer: The article should not be taken as, and is not intended to provide any investment advice. Claims made in this article do not constitute investment advice and should not be taken as such. 101 Blockchains shall not be responsible for any loss sustained by any person who relies on this article. Do your own research!

The post Know Everything About Wrapped Bitcoin appeared first on 101 Blockchains.