The metaverse has jumped straight from the pages of science-fiction to real life, and it might become a reality soon. After Facebook announced its metaverse project last year, it is only a matter of time before the shift to virtual reality becomes standard practice. The Metaverse Index has come up with a unique solution for users to participate in the metaverse through access to multiple protocols rather than a single token.

According to the founders of the index, MVI aims to capture the trends in transition of entertainment, business, and social activities towards virtual economies, on the foundations of blockchain technology and NFTs. The following discussion helps you understand the metaverse index or MVI and its components with a detailed introduction to basics. On top of it, you can also learn about the existing tokens on the index and methods for buying MVI.

Aspiring to Become a Certified Metaverse Expert? Enroll in Certified Metaverse Professional (CMP) Certification Course Now!

What is Metaverse Index?

The first thing in any discussion about MVI or metaverse index would obviously emphasize its definition. MVI is basically an index product designed for tracing the trends pertaining to transition of entertainment, business, social activities, and sports to virtual environments. It was launched in 2021 by Index Coop, a crypto index solution provider. Index Coop itself is a decentralized, community-driven organization responsible for creation and maintenance of other crypto indices such as Bankless BED Index and DeFi Pulse Index.

The metaverse is a massive and open live virtual universe which can offer many interesting benefits to users. Users can have a sense of provenance, shared spatial awareness, and social presence. At the same time, the metaverse opens up the doors to an extensive virtual economy. It is also important to note how digital ownership and free markets in the metaverse use blockchain technology, thereby setting a difference from social contracts governing web2 solutions.

MVI, or the Metaverse NFT Index, can help investors discover an opportunity for investing in the metaverse. How? The index can help in capitalizing on the choice of metaverse protocols rather than investing your assets on one platform or token. You can think of MVI as a gateway for beginners into the world of the metaverse. Who developed the index?

Origins of Metaverse Index

One of the significant details in a guide on investing in metaverse index would focus on its origins. The founders of MVI, Verto0912, and DarkForestCapital, launched the index for the first time without any external partners. It was the first sole project of Index Coop. Verto0912 and DarkForestCapital have been the early members of Index Coop since its foundation in 2020.

Verto helped in resolving the low liquidity issues in certain tokens by modifying the calculation of weighting in the initial proposal for MVI. Index Coop also supported the development of MetaPortal as a substack for establishing MVI as a unique brand. The MetaPortal serves as a reliable tool for the methodologists to develop expertise in the metaverse. What type of tokens can you find in the MVI index?

Want to learn blockchain technology in detail? Enroll Now in Certified Enterprise Blockchain Professional (CEBP) Course

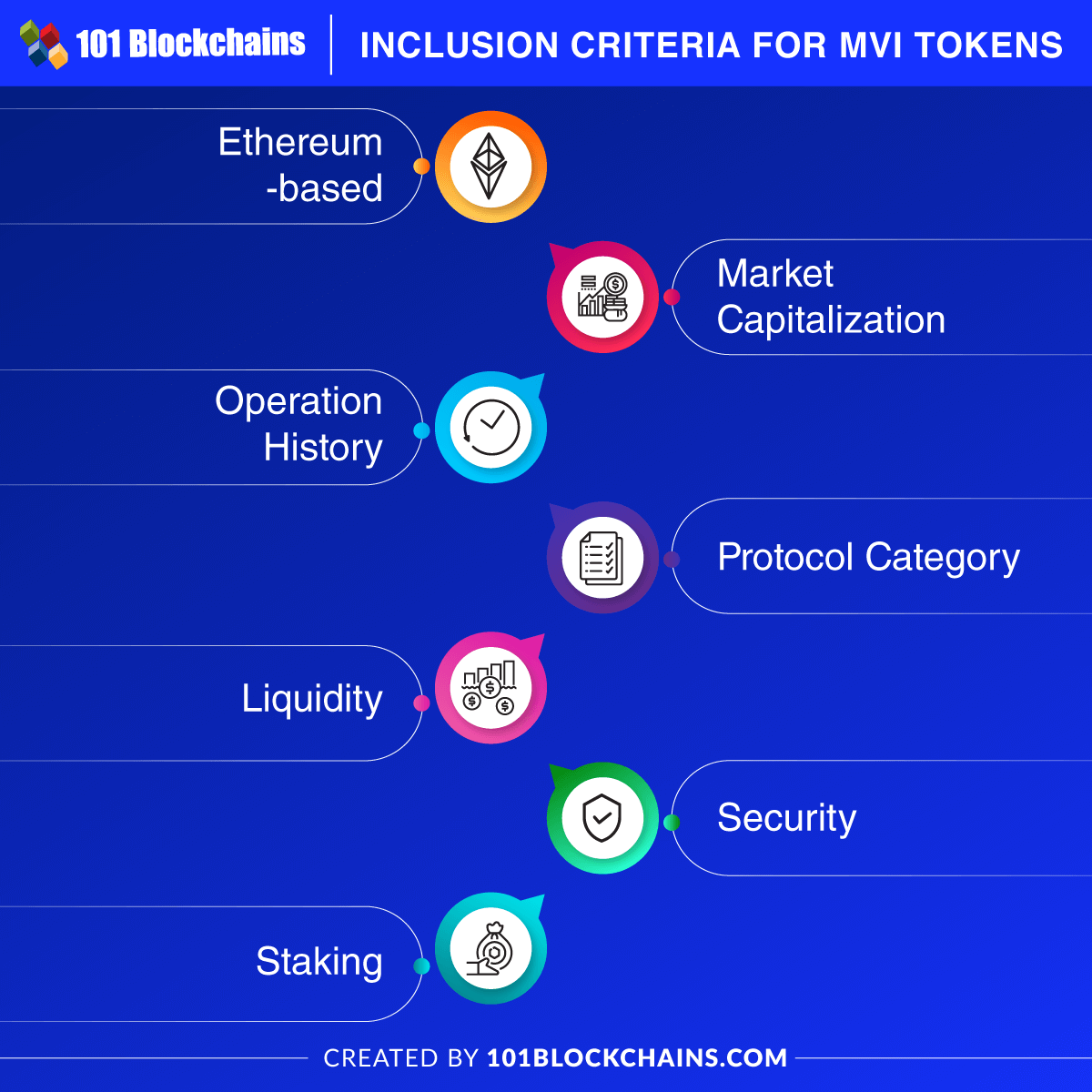

Inclusion Criteria for MVI Tokens

The benefit of investing in the desired metaverse protocol through MVI can be quite appealing. You might look for a Metaverse Index chart to figure out the calculations before landing up in the metaverse. However, it is important to identify the criteria for tokens that can be included in the MVI index. If you want to invest in a specific asset, you must know about what it has to offer you. Here are some important conditions for inclusion in the MVI index.

-

Ethereum-based

The first criterion for including a token on metaverse index is that the token should be available on Ethereum blockchain. MVI plans on revising this criterion by introducing a multi-chain Set Protocol infrastructure.

-

Market Capitalization

The token must have a circulating market capitalization of more than $50 million.

-

Operation History

The protocol eligible for metaverse index or MVI must have around 3 months of history of operations. In addition, the token of the protocol must showcase a price and liquidity history of a minimum of 3 months.

-

Protocol Category

As of now, the Metaverse NFT index rightly fulfills the purpose of its name through inclusion of NFTs. The protocols included on MVI must comply with specific token categories such as NFTs, music, entertainment, augmented reality, and virtual reality. MVI would add more token categories with the growing maturity of the market.

-

Liquidity

The tokens eligible for inclusion in MVI must register proof of consistent and reasonable levels of DEX liquidity on Ethereum.

-

Security

A protocol suite for the Metaverse Index chart should also pass through an independent security audit. At the same time, a product methodologist must have reviewed the results of the security audit. Without audits, methodologists can use subjective assessment of the protocol on the grounds of other criteria and interactions with community.

-

Staking

The tokens listed on MVI or metaverse index will not be staked at the beginning of the index. On the contrary, an increase in liquidity can open up the scope for yield generation through staking on MVI.

Excited to learn the basic and advanced concepts of ethereum technology? Enroll Now in The Complete Ethereum Technology Course

How Does Metaverse Index Work?

The most important highlight in the working of MVI is the index weight calculation method. In addition, you must also learn about the index maintenance process as they account for the methodology of the metaverse index. The discussion on “what is metaverse index” would remain incomplete without identifying how MVI works after selecting tokens for inclusion.

-

Calculation of Index Weight

The working of MVI involves the immediate step following the identification of eligible tokens. It is important to estimate the suitable weighting for every token in the index. Methodologists calculate the final weights of the tokens in metaverse index by determining the aggregate value of DEX liquidity and square root of the market capitalization of tokens. The square root of market capitalization of the token accounts for around 75% of their final weight. On the other hand, the DEX liquidity accounts for the remaining 25% of the final weight of a token.

The basic index weight calculation method emphasizes liquidity, and it ensures that the index does not include overallocated to assets that cannot be rebalanced through DEX. The adequate sum of liquidity for tokens associated with Metaverse Index or MVI is important for preventing significant slippage in monthly rebalances. The simple formula for calculating the weight of each token is as follows,

TW= 75%xRMCW + 25%xLW TW represents the total weight of a token in MVI. RMCW represents the square root of market capitalization of the token. LW is the aggregated DEX liquidity of a token.

-

Index Maintenance

Another significant aspect in the understanding of MVI or metaverse index refers to the index maintenance process. The methodologists take care of the index maintenance process to preserve the index quality. The index maintenance process involves two distinct stages, the determination phase, and the rebalancing phase. In the determination phase, tokens are subjected to a re-evaluation of inclusion criteria for adding or deleting tokens from the index. The determination phase happens in the final week of the quarter. The rebalancing phase involves modifications in the index composition for updating new weights in the first week of the upcoming quarter.

Get familiar with the terms related to metaverse with Metaverse flashcards

Which Tokens Are Available on MVI Now?

The obvious question for any individual interested in investing in metaverse index would emphasize the tokens available in MVI now. Here is an outline of the tokens you can find in the index now.

Illuvium

Illuvium has evolved as one of the popular metaverse gaming platforms based on Ethereum blockchain. The native governance token of the platform is ILV.

Axie Infinity Shards

AXS, the governance token on Axie Infinity, is a leading name in the play-to-earn landscape right now.

Enjin

ENJ is another notable entry in the current Metaverse Index chart and serves as the utility token for powering up the NFT economy of Enjin. The ENJ token can help in development, trading, and monetization of gaming NFTs.

Decentraland

The MANA token of Decentraland is also one of the notable entries in MVI as Decentraland is a pioneer among metaverse platforms.

The Sandbox

The SAND token of Sandbox, a community-driven metaverse platform, is also a top player in MVI index for its role in fuelling a gaming economy.

Some of the other notable tokens available on the metaverse index include the following,

- WAXE (WAX)

- AUDIO (Audius)

- ERN (Ethernity Chain)

- NFTX (NFTX)

- TVK (Terra Virtua)

- RARI (Rarible)

- DG (Decentral Games)

- WHALE (WHALE)

- REVV (REVV)

- MUSE (NFT20)

Aspiring to Become a Certified NFT Expert? Enroll in Certified NFT Professional (CNFTP) Course Now!

Where Can You Buy Metaverse Index?

The MVI token lets you capitalize on the value of a wide base of metaverse protocols without concentrating the risk on one platform or token. If you are wondering where to buy metaverse index, then you must look for the reasons to do so. First of all, you can buy MVI if you are interested in the metaverse and don’t know where to start investing.

You would find the advantage of encompassing multiple trends in the world of metaverse without betting on one specific platform, token, asset, or virtual experience. Interestingly, you don’t have to search too far for investing in metaverse index, as you can find it on Ethereum and Polygon. You have to connect your wallet with the required amount of ETH and swap it for MVI. In addition, decentralized exchange aggregators are also a great answer to purchase metaverse index.

Want to learn Metaverse concepts quickly? Check out Now Metaverse Flashcards and Metaverse FAQs

Bottom Line

The overall introduction to metaverse index showcases how it can revolutionize the metaverse experience for users. If you take a closer look at how it works, MVI brings the best of all metaverse platforms and tokens into one pool. Any MVI token holder can have the privilege of drawing the best of multiple metaverse platforms and tokens according to their requirements.

You don’t have to put all your money on a single metaverse token and trust in its long-term potential for growth. On the contrary, MVI follows a straightforward approach to including the best tokens in the index. If you want to invest in MVI, you need to dive deeper into research regarding financial, tax, and legal implications of the same. Learn more about MVI and how it can drive the adoption of a metaverse in the future.

Join our annual/monthly membership program and get unlimited access to 25+ professional courses and 55+ on-demand webinars.

*Disclaimer: The article should not be taken as, and is not intended to provide any investment advice. Claims made in this article do not constitute investment advice and should not be taken as such. 101 Blockchains shall not be responsible for any loss sustained by any person who relies on this article. Do your own research!

The post What is Metaverse Index (MVI)? appeared first on 101 Blockchains.