The consistent rise in recognition for the utility of decentralized solutions has spurred the development of many new innovative solutions. You must have heard about cryptocurrencies, NFTs, and DeFi solutions in the different discussions around blockchain technology. Have you come across the concept of DAOs or Decentralized Autonomous Organizations? DAOs introduced massive disruptions in the conventional top-down models used for defining organizational operations.

On the contrary, Decentralized Autonomous Organizations offer a community-driven approach to the operations of an organization. How is DAO treasury management useful for the future of DAOs? Though promising entities in the decentralized ecosystem, DAOs are still in the developmental stages and rely on efficient treasury management. The DAO treasury is significant for fuelling the longevity of an organization as the treasury offers financial resources required for the development and growth of DAOs.

Many Decentralized Autonomous Organizations have started experiments with multiple ways of leveraging capital for their treasuries. The primary focus of DAOs in developing a treasury deals with achieving resilience towards unprecedented events and bear markets. What are the problems in crypto treasury management, and how can DAOs address them? The following post offers you an introduction to DAO treasuries and the best practices for managing them. Most important of all, the post helps you identify the underlying reasons for the effective management of DAO treasuries.

Want to be a certified professional in blockchain technology? Enroll Now in the Certified Enterprise Blockchain Professional (CEBP) Certification Course.

What are DAO Treasuries?

The obvious highlight in a discussion on managing DAO treasuries would focus on the definition of DAO treasuries. Interestingly, you can develop a better understanding of answers to “What is a DAO Treasury?” by reflecting on the definition of DAOs. Decentralized Autonomous Organizations, or DAOs, are new coordination mechanisms or digitally-native organizations based on smart contracts.

Smart contracts help in defining and implementing the rules for the governance of the organization. DAOs operate on a community-based ownership model in which a group of people works together to achieve shared goals. Users can identify multiple approaches for participation in DAOs, such as purchasing the governance tokens of the DAO. Owners of the governance tokens could participate in different governance activities of the DAO.

Decentralized Autonomous Organizations feature multiple distinct aspects in comparison to traditional models of organizations. However, the treasury management aspect in DAOs is considerably similar to that of traditional organizations. The most important common highlight between DAOs and traditional organizations would refer to the necessity of capital for funding the organization’s operations. The DAO treasury is the pool of funds for the continuous growth and development of the organization. Members of the DAO could rely on the specified governance mechanisms for determining the allocation of the DAO treasury funds.

Learn how to build smart contracts with Solidity. Enroll in our Solidity Fundamentals Course Now!

Existing State of DAO Treasuries

A guide on the best practices to manage DAO treasury must also reflect on how DAO treasuries work now. The common sight in the DAO landscape highlights the concentrated DAO treasuries, with all the assets in the form of native crypto tokens of the DAO. One of the examples of DAO treasury refers to Uniswap, a decentralized exchange with a popular DeFi solution. The Uniswap DAO treasury has almost $2.3 billion, and all of them are in the form of the UNI governance token. Therefore, the treasury of Uniswap fluctuates on a 1:1 ratio with the price of the UNI token.

You can also notice another example of concentrated DAO treasuries in the case of Compound, a popular decentralized money market protocol. The Compound DAO treasury has almost $172 million, and around 94% of it is held in the form of COMP tokens. The COMP token also registers significant levels of volatility on a day-to-day basis, like the UNI token.

With the native tokens, DAOs could convey a strong sense of dedication to the shared goals of the organization. At the same time, the native tokens can also help DAO treasuries capitalize on the benefits of price appreciation and organic growth for the DAO. On the other hand, a drastic reduction in the price of the native token could lead a DAO to unexpected circumstances.

Want to get an in-depth understanding of crypto fundamentals, trading and investing strategies? Become a member and get free access to Crypto Fundamentals, Trading And Investing Course.

Problems for DAO Treasuries

The emphasis on best practices for DAO treasury management has been growing with the consistently emerging issues with DAO treasuries. The DAO treasury has to address the daily operational needs of the organization alongside enabling long-term investments for innovative upgrades or growth initiatives.

However, DAOs experience many critical troubles in reaching a consensus regarding the management of assets in the DAO treasury. Most of the existing DAO treasuries experience problems with diversification and liquidity provisioning. In addition, it is also important to notice the problems with concentrated DAO treasuries.

The need for decentralized autonomous organization treasury management is clearly evident for resolving the problems with DAO treasuries like depletion of value. Price fluctuations are a common event in the crypto market. However, it can affect DAO treasuries that have concentrated native tokens as the whole treasury could deplete in value with the price fluctuation for native tokens.

At the same time, low prices of the native token do not imply that the expenses for the DAO would reduce. For example, the treasury size of Uniswap DAO was reduced by almost 50% due to the price drop of the UNI token. Such types of losses could emerge as a prominent concern in DAO treasury management.

Want to become a Cryptocurrency expert? Enroll Now in Cryptocurrency Fundamentals Course

Solutions for DAO Treasury Management

The problems of DAO treasuries imply the urgency of DAO treasury management with solid reasons. However, you can try credible solutions for managing DAO treasuries, such as diversification and enabling liquidity. Let us take a look at how these solutions can help you address the management needs of a DAO treasury.

-

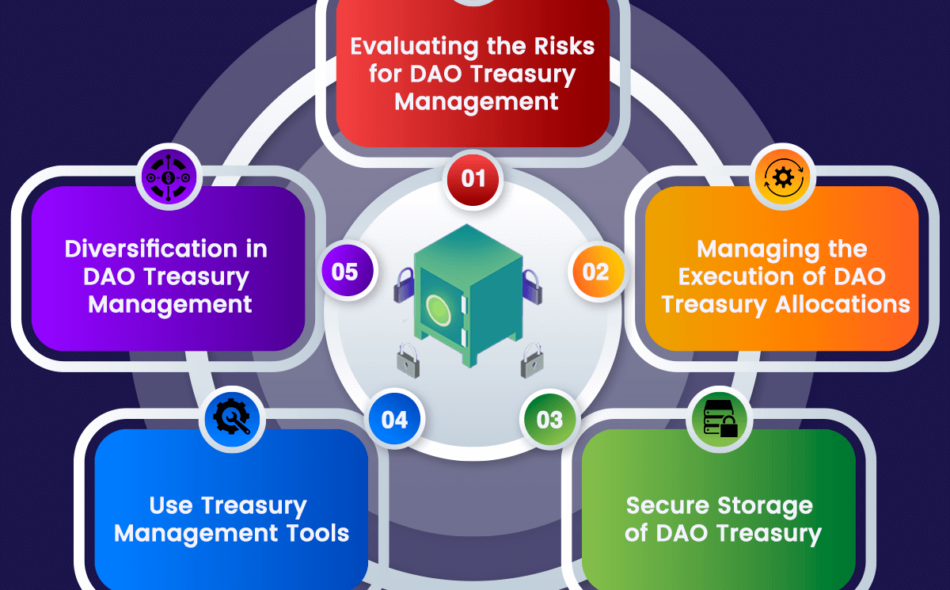

Diversification in DAO Treasury Management

Diversification is one of the basic practices for reducing risks to investment portfolios. It could help in reducing the unprecedented risks of the DAO treasury, such as price volatility. Diversification ensures that the risks of price fluctuation do not affect only one asset. Native tokens could depreciate by more than 70% and eat away at the DAO treasury by substantial amounts. DAOs could diversify into less risky assets and achieve longer runways on the basis of resistance to volatility.

The use of diversification as one of the methods for crypto treasury management also helps in managing predictable budgets. DAOs could create subgroups such as grants committees and working groups for allocating a specific amount of native tokens. In such cases, the subgroups could not evaluate the expected budget, owing to fluctuations in the prices of the native token. Diversification could ensure that subgroups focus specifically on primary tasks to enhance DAO efficiency.

The definition of “What is a DAO Treasury?” offers insights into not only their potential problems but also the relevant solutions. For example, diversification could help in encouraging risk-averse contributors to participate in the DAO through stablecoin payments. DAO treasuries can offer the option for partial or full payments in fiat currency, or stablecoins could reduce the risks.

DAOs could also offer stablecoin liquidity in DeFi protocols and use the liquidity provisioning rewards for treasury management. One of the prominent examples of using liquidity as a solution to manage DAO treasury is evident in the case of Uniswap. The decentralized protocol achieves stablecoin liquidity through v3 stablecoin pools, which offer not only better liquidity but also the opportunity to gain transaction fees. However, liquidity provisioning in the case of low-risk yields can lead to risks of stablecoin devaluation or smart contract failure.

Want to learn the basic and advanced concepts of Stablecoin? Enroll in our Stablecoin Masterclass Now!

-

Evaluating the Risks for DAO Treasury Management

The implications of diversification for resolving concerns in managing DAO treasuries provide viable answers. However, you have to focus on the element of ‘risk’ in managing a DAO treasury as a best practice. The best practices for DAO treasury management have to understand that the primary responsibility of a DAO for effective treasury management relies on risk management. How can a DAO treasury determine the risks? Decentralized Autonomous Organizations could evaluate risks in four distinct areas such as expertise, recognition of risk, estimating risk, and execution risks.

The first element of risk for DAO treasuries points to expertise in managing operations. Will the DAO manage all investments on its own or rely on dApps or third-party organizations? While third-party professional services organizations could support treasury management, they also bring technical risks. DAO treasuries can safeguard themselves against such risks by opting for insurance.

DAOs should also rely on the acknowledgment of risks with every investment to ensure effective treasury management. The practices for decentralized autonomous organization treasury management must consider specialized teams and procedures for transparent risk assessment of treasury allocations.

Another important highlight in the best practices for managing DAO treasuries would focus on the evaluation of risks. With a quantified impression of the risks for DAO treasury, members could make relevant allocation decisions. Some of the popular conventional techniques adopted in the domain of engineering and finance could help DAO treasuries in embracing the basic safeguards. For example, Value at Risk or VAR analysis and Failure Mode and Effects Analysis or FMEA are proven solutions for risk management in DAO treasuries.

-

Managing the Execution of DAO Treasury Allocations

Apart from the evaluation of risks for DAO treasuries to facilitate effective management, members must also focus on execution risks. The execution risks primarily refer to the method of providing allocations and focusing on issues with talent and systems underlying the DAO.

One of the integral aspects of DAO treasury management focuses on the necessity of talent with the required skills and experience for taking decisions on treasury allocations. Similarly, the systems used for storing and managing the DAO treasury are also important facets of execution risks. System risks could consider gas fees, human error, and system limitations into consideration for effective treasury management.

The management of execution risks for DAO treasuries must also focus on resolving the high signal-to-noise ratio. How? The recommended solution is evident in the example of Pickle Finance, which resolved the problem of noise around treasury allocations. Pickle Finance opted for voting on DAO treasury allocation through a smaller and dedicated community for treasury management. The treasury management committee operates on day-to-day operations autonomously and refers to the community for major decisions.

Want to learn about Ethereum Technology? Enroll now in The Complete Ethereum Technology course.

-

Secure Storage of DAO Treasury

The list of best practices for DAO treasury management would also emphasize secure storage of the DAO treasury. Most of the DAOs leverage multi-sig wallets for storing their treasury, as they can provide opportunities for collaborative transactions with DAOs. First of all, multi-sig wallets work by locking up the funds of users in smart contracts alongside the facility of on-chain transaction verification.

As a result, you do not have any funds in the browser or any wallet provider taking care of the management of private keys. Multisig wallets also offer the ideal prospects for developing a shared ownership model suited to a DAO structure. Furthermore, multi-sig wallets could also help in retrieving wallet access in event of losing their private keys by inviting a new account into the multi-sig.

Learn more about crypto wallets with our FREE presentation on Crypto Wallet Types Explained

-

Use Treasury Management Tools

Another proven practice to manage DAO treasury involves the use of treasury management tools. You can find multiple tools for addressing different requirements of treasury management, including diversification, reporting, and risk assessment. Some of the popular tools for managing DAO treasuries include Yearn Finance, Hedgey, Balancer, and Llama.

For example, Hedgey offers support for two prominent diversification strategies through the Treasury Pools Conditional Calls protocol and an OTC protocol. Both the protocols of Hedgey support unique goals in treasury management for DAOs, according to scale, maturity, and the needs of the DAO community and treasury.

Want to learn and understand the scope and purpose of DeFi? Enroll Now in Introduction to DeFi – Decentralized Finance Course!

Bottom Line

The outline of best practices to support DAO treasury management shows that decentralized autonomous organizations can explore new opportunities for development and growth with limited risks. Considering the growing scale of DAOs, it is important to identify the complexity of determining treasury allocations.

Starting from diversification to risk management and the resolution of execution risks, DAO treasury managers have a lot on their table. Interestingly, treasury management tools could serve as viable answers for resolving the conventional problems experienced by treasury managers. If a DAO is new and does not have proven infrastructure for treasury management, you can rely on suitable tools. Learn more about treasury management for DAOs in detail now.

*Disclaimer: The article should not be taken as, and is not intended to provide any investment advice. Claims made in this article do not constitute investment advice and should not be taken as such. 101 Blockchains shall not be responsible for any loss sustained by any person who relies on this article. Do your own research!

The post A Deep Dive into DAO Treasury Management appeared first on 101 Blockchains.